Auto Insurance in and around Tulsa

Tulsa's first choice car insurance is right here

Time to get a move on, safely.

Would you like to create a personalized auto quote?

Insure For Smooth Driving

Everyday life often takes on a rather predictable routine. We drive to school, book clubs, baseball practice and violin lessons. We go from one thing to the next and back again, almost automatically… until trouble finds you on the road: things like darting deer, flying objects, hailstorms, and more.

Tulsa's first choice car insurance is right here

Time to get a move on, safely.

Great Coverage For A Variety Of Vehicles

That’s why you need State Farm auto insurance. When the unexpected happens, State Farm is there to get you back on track! Agent Velta Augusta can walk you through the whole insurance process, step by step, to review State Farm's options for savings and deductibles. You’ll get reliable coverage for all your auto insurance needs.

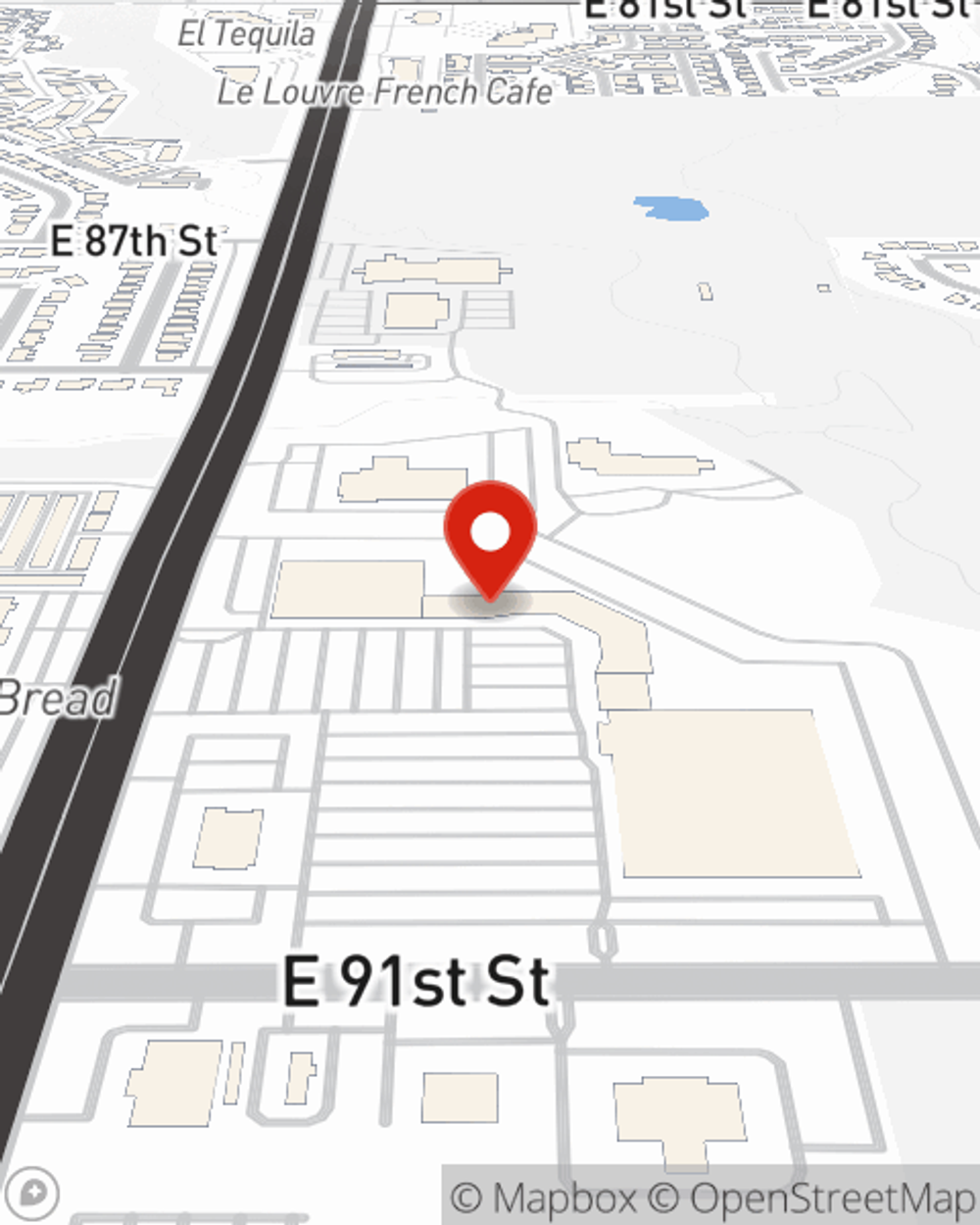

State Farm agent Velta Augusta is here to help lay out all of the options in further detail and work with you to design a policy that is right for you. Call or email Velta Augusta's office today to discover more.

Have More Questions About Auto Insurance?

Call Velta at (918) 254-1959 or visit our FAQ page.

Simple Insights®

How to choose a first car for a teenager

How to choose a first car for a teenager

Buying your teen’s first car? Learn how to choose a safe and reliable vehicle with tips on safety, reliability, insurance costs and more to help you make informed decisions for your new driver.

Usage-based car insurance for multiple drivers

Usage-based car insurance for multiple drivers

Learn how usage-based auto insurance works with multiple drivers on one policy and how the combined driving habits may affect costs and potential savings.

Velta Augusta

State Farm® Insurance AgentSimple Insights®

How to choose a first car for a teenager

How to choose a first car for a teenager

Buying your teen’s first car? Learn how to choose a safe and reliable vehicle with tips on safety, reliability, insurance costs and more to help you make informed decisions for your new driver.

Usage-based car insurance for multiple drivers

Usage-based car insurance for multiple drivers

Learn how usage-based auto insurance works with multiple drivers on one policy and how the combined driving habits may affect costs and potential savings.